|

Congress made Civil War culprit

for initiating federal income tax

Who do you blame for initiating the federal income tax?

The U.S. Congress is the responsible party and the Civil War is proclaimed to be the reason.

On Aug. 5, 1861, Congress passed a Revenue Act that greatly expanded the government’s taxing authority, including the imposition of the first income tax.

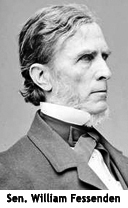

Although controversial, Sen. William Fessenden, a Maine Republican, was able to push it through quickly, reflecting the fiscal challenges facing the federal government. Although controversial, Sen. William Fessenden, a Maine Republican, was able to push it through quickly, reflecting the fiscal challenges facing the federal government.

The United States began the Civil War in poor financial condition. The country had not recovered from the 1857 recession, which was perhaps the first global recession. Several years of prosperity had resulted in speculation and over expansion and, when a series of bad investments led to the collapse of the Ohio Life Insurance and Trust Company, the economy quickly shrank as terrified banks called loans, companies fired workers and revenues stopped flowing.

The U.S. government was running consistent deficits and the new president, Abraham Lincoln, immediately was faced with how to finance a war to keep the country whole.

House Ways and Means chairman Thaddeus Stevens, a Pennsylvania Republican, summed up the sentiment of Congress:

“This bill is a most unpleasant one. But we perceive no way in which we can avoid it and sustain the government. The rebels, who are now destroying or attempting to destroy this Government, have thrust upon the country many disagreeable things.”

The act imposed a wide range of import duties and created a federal property tax on real estate based on the population in each state.

To enforce and collect the tax, the act also established a system of tax districts with assessors and collectors.

The act imposed an income tax of three percent on all income above $800 per year. The tax affected about three percent of Americans and was widely supported. It did specify that the income tax would expire in 1866.

The number of new, complicated taxes was not accompanied by clear instructions or mechanisms to enforce them. As a result, the taxes collected represented significantly less revenue than projected.

Congress passed a more comprehensive revenue act on July 1, 1862, that broadened the income tax, expanded the use of excise taxes to cover nearly all goods sold and imposed stiff luxury taxes and created the office of the commissioner of Internal Revenue (later expanded and renamed the Internal Revenue Service).

The broader income tax exempted individuals making less than $600 per year (about $14,000 in 2013); taxed those making between $601 and $10,000 annually at three percent of total income; and imposed a tax of five percent of total income for those making more than $10,000 (about $225,000 in 2013).

The act also inaugurated the concept of withholding income tax at the source of the funds.

However, there still was not enough revenue and the income tax rates were increased in 1864 and the sunset provision revoked. A sunset revision automatically repeals the entire or sections of a law once a specific date is reached.

The income tax was repealed in 1872.

A flat-rate income tax passed in 1894 was ruled unconstitutional, but when the 16th Amendment was ratified on Feb. 3, 1913 (it exempted income taxes from constitutional requirements), the federal government had the authority it needed to levy taxes on income regardless of source.

|

Although controversial, Sen. William Fessenden, a Maine Republican, was able to push it through quickly, reflecting the fiscal challenges facing the federal government.

Although controversial, Sen. William Fessenden, a Maine Republican, was able to push it through quickly, reflecting the fiscal challenges facing the federal government.